An Introduction to Real Estate Syndications

Is this real estate syndication guide for you?

Are you seeking to accumulate wealth and generate passive income, but want to avoid the headaches and hassles of personally owning and managing small investment properties?

Are you interested in investing in the same high-quality, recession-resistant commercial properties that the top 1% invest in, with as little as $25-50k of your own money?

Perhaps you're looking to move some or all of your funds out of the volatile stock market and into a more predictable asset?

If so, real estate syndications could be the passive investment model you've been searching for.

Before making any investments, it's crucial to familiarize yourself with the advantages and disadvantages of real estate syndications. This concise guide will assist you in navigating that path.

What exactly is a real estate syndication?

At its core, a real estate syndication offers a solution for investors looking to combine their funds, expertise, and assets to acquire a commercial real estate property. This collaboration empowers investors to access valuable real estate assets that may have been unattainable individually due to the associated costs and intricacies of the acquisition process.

Who are the players in a real estate syndication?

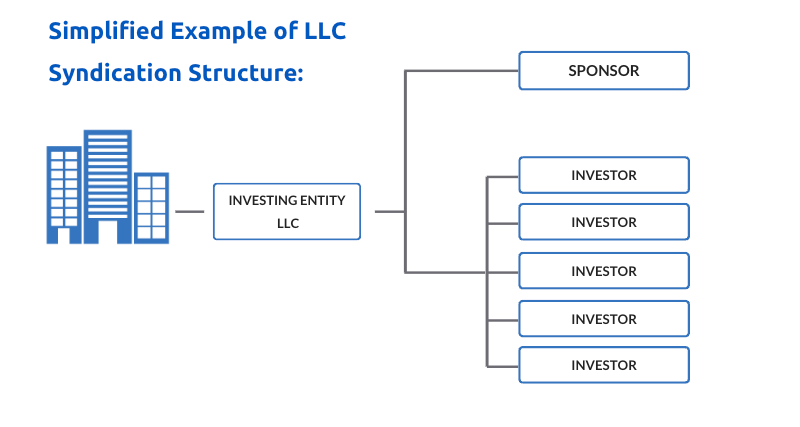

Generally speaking, there are two different types of players in an apartment syndication - sponsors and investors.

Sponsors

The real estate syndication sponsor could be one or more individuals who are responsible for the success or failure of the entire project on behalf of all investors involved. Sponsors are also known as syndicators, operators, and general partners (GP’s).

The Sponsor or Sponsorship team is responsible for:

- Finding the deal

- Negotiating the contract

- Completing due-diligence

- Securing financing

- Raising equity

- Executing the business plan

Because the success of a deal relies heavily on the execution of the sponsorship team, it is crucial to partner with a sponsor who has a strong track record of performance, has a clear business plan, and thoroughly understands the market they plan to invest in.

Investors

The investors are a group of individuals who play a passive role in the syndication. They are responsible for funding the deal by bringing capital to the table. They have no other responsibilities outside of their capital investment. They are completely passive. The investors in a syndication are often referred to as limited partners (LPs).

The U.S. Securities and Exchange Commission (SEC) limits those who can invest in real estate syndications to accredited or sophisticated investors.

Accredited Investors

According to the SEC, you would qualify to be an Accredited Investor if:

- You have earned an income of at least $200,000 each year for the previous two years

- You and your spouse have earned a combined income of at least $300,000 each year for the previous two years

- You individually or in combination with your spouse have a net worth of at least $1,000,000 excluding your primary residence.

Sophisticated Investors

The SEC defines a sophisticated investor as an individual who has, sufficient knowledge and experience in financial and business matters to evaluate the merits and risks of the prospective investment and has a substantive pre-existing relationship with the sponsor.

How are real estate syndications structured?

Multifamily Syndications can be structured in a handful of different ways but are often structured as a Limited Liability Company (LLC). The LLC syndication model would involve creating a separate entity and operating agreement. The Operating Agreement would establish the operational details, such as:

- The income logistics

- Voting rights and buyout terms

- Profit-sharing and payout distribution

- Distribution structure when the property sells

What are the steps in a real estate syndication?

- Find the property - First, the syndicator would find a property they believe match their investment objectives.

- Offer and negotiations - The syndicators work with brokers and attorneys to offer on the property. Once price and terms are agreed to by both parties, they move to the next step.

- Due diligence, financing, equity, legal - Once under contract, the sponsor will begin due diligence on the property, secure the required capital from investors, pursue debt financing from a lender and prepare SEC required legal documents known as a Private Placement Memorandum (PPM).

- Close on the acquisition - Once the required funds have been raised from investors, due diligence has been completed, and financing has been secured, the Sponsor will close on the sale and begin executing on the business plan.

- Ongoing management - With the help of the management team, the property is managed and operated according to the business plan. Distributions and management fees will start to be paid out to the sponsors, and investors, as outlined in the PPM.

What are the Pro's and Con's of investing in a real estate syndication?

The cons to investing in real estate syndications include:

- Lack of control -- you are a passive investor and rely on the sponsor to execute the business plan for you.

- Lack of liquidity - each syndication can be structured differently but investors should plan to have their capital illiquid until the property is sold.

- Holding period - Most syndications have a minimum expected holding period of 3 years and often up to 7 to 10 years.

- Performance - by buying an investment property yourself, you may be able to produce better returns than passively investing in a syndication.

The pros of investing in real estate syndications may include:

- Get started now - You can invest in commercial real estate without experience or significant financial resources.

- Diversity - You can diversify your investments among multiple syndications with varying asset types and geographic locations

- Passive - You can passively invest with an experienced syndicator who will manage the property for you. You don’t have to do any of the work but still participate in the benefits

- Liability Protection - Syndications are structured in a way that limits your liability as a passive investor.

- Tax Benefits - One of the main reasons investors choose to invest in commercial real estate is for the significant tax advantages.

- Cash Flow - many syndications start paying out monthly or quarterly distributions from day one.

Conclusion

While real estate syndications may seem complex, they offer an exceptional opportunity for investors to embark on a journey of wealth creation and establish passive streams of income through commercial-grade assets. We trust that this concise guide will assist you in your pursuit of successful investing.

Schedule a strategy call with us today to discuss your real estate investing goals.

Disclaimer: Before we end it is important to note that Canovo Group, LLC and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction

NO OFFERS OF SECURITIES: Under no circumstances should any material in this guide be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments.