Multi-Unit Rental Rates in Utah for 2024

As Utah continues to experience significant population growth and economic expansion, the demand for rental properties has remained robust.

For investors and property owners, understanding the rental market trends is crucial for setting competitive rates, maximizing occupancy, and ensuring long-term profitability.

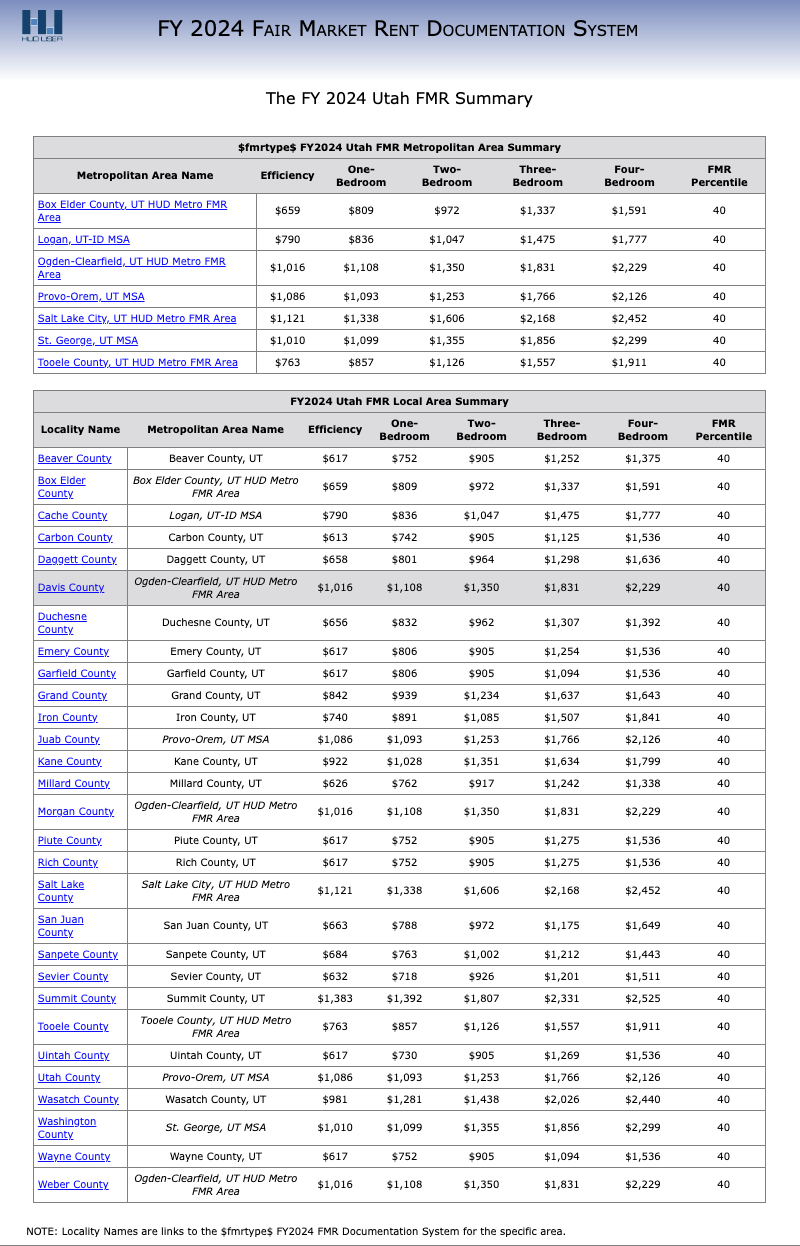

In this article, we’ll break down the 2024 Fair Market Rent (FMR) rates across Utah’s counties, focusing on multi-unit properties, to give you a clear picture of what to expect in the year ahead.

The Importance of Fair Market Rent (FMR) Data

Fair Market Rent (FMR) is a critical benchmark used by the U.S. Department of Housing and Urban Development (HUD) to determine payment standards for various housing assistance programs.

However, it’s also a valuable tool for landlords and investors, as it provides a snapshot of the rental market conditions across different regions and property sizes.

By analyzing the 2024 FMR data for Utah, property owners can make informed decisions about setting rental rates that align with local market conditions while ensuring their properties remain competitive.

Key Insights from the 2024 Utah FMR Report

The 2024 FMR report for Utah provides detailed rental rate data across different counties and metropolitan areas, segmented by the number of bedrooms. Here’s a breakdown of some key findings:

1. Metropolitan Areas with High Rental Rates

- Salt Lake City, UT HUD Metro FMR Area: Unsurprisingly, the Salt Lake City metro area leads the state with the highest rental rates. For example, a one-bedroom unit averages $1,338 per month, while a four-bedroom unit commands up to $2,452. These rates reflect the strong demand in Utah’s largest city, driven by its economic opportunities and cultural amenities.

- Provo-Orem, UT MSA: Another high-demand area, Provo-Orem, offers rental rates of $1,093 for a one-bedroom and $2,126 for a four-bedroom unit. The presence of major universities and tech companies contributes to the strong rental market in this region.

2. Emerging Markets with Competitive Rates

- Ogden-Clearfield, UT HUD Metro FMR Area: This area has seen growing interest due to its more affordable housing options compared to Salt Lake City. Here, rental rates are $1,108 for a one-bedroom and $2,229 for a four-bedroom unit. The area’s blend of affordability and proximity to job centers makes it attractive for renters and investors alike.

- St. George, UT MSA: Known for its warm climate and outdoor recreational opportunities, St. George’s rental market is also robust, with rates of $1,099 for a one-bedroom and $2,299 for a four-bedroom unit. The city’s growth as a retirement and tourism destination has bolstered demand for rental properties.

3. Counties with the Most Affordable Rental Rates

- Sevier County: For those looking at more rural or suburban investments, Sevier County offers some of the most affordable rental rates in Utah, with one-bedroom units averaging $718 and four-bedroom units at $1,511.

- Emery County: Another affordable option, Emery County’s rental rates are $806 for a one-bedroom and $1,536 for a four-bedroom unit. These areas, while less populated, may appeal to renters seeking lower costs and a quieter lifestyle.

Implications for Investors and Property Owners

Understanding these FMR trends is vital for setting competitive rental rates in 2024. Here’s how you can use this data to your advantage:

- Market Positioning: If you own properties in high-demand areas like Salt Lake City or Provo-Orem, consider the upper range of FMR data to ensure you’re capturing the full potential of your rental income. Conversely, in more affordable regions, competitive pricing might be key to attracting and retaining tenants.

- Investment Strategy: For investors, these trends highlight potential opportunities. Areas like Ogden-Clearfield and St. George offer solid returns with growing demand, while counties with lower rates may present opportunities for those looking to invest in more affordable markets with less competition.

- Property Upgrades: In regions where rental rates are rising, consider upgrading your units to justify higher rents. Modern amenities, energy-efficient appliances, and updated interiors can make your property more appealing and allow you to command higher rates.

Conclusion: Navigating Utah’s 2024 Rental Market

The 2024 FMR data for Utah provides valuable insights into the state’s rental market, helping property owners and investors make informed decisions.

By understanding the trends in different counties and metropolitan areas, you can position your properties effectively, maximize your rental income, and make strategic investment choices.

At Canovo Group, LLC, we’re committed to helping you navigate Utah’s real estate market with confidence. Whether you’re looking to buy, sell, or optimize your rental properties, our team is here to support you every step of the way.

Contact us today to learn more about how we can help you achieve your real estate goals in 2024.

Subscribe to The Canovo Report

Join 4,000+ Utah Investors and get our weekly investor report and deal alerts filled with investing opportunities, data and insights to make you a better investor.

Whenever you’re ready, there are a couple of ways we can help you:

1. Get Access to Exclusive, Off-Market, Value-Add Multi-Unit Deals:

We work with a select number of serious buyers through our Off-Market Acquisition System™—a proven process for quietly sourcing 4–50 unit properties directly from long-term owners before they ever hit the MLS.

2. Sell Your Multi-Unit for Top Dollar and Grow Your Wealth:

List your multi-unit property on the Utah MLS and dozens of other websites through our brokerage and save thousands with our flat fee MLS listing.

3. Subscribe to Our Weekly Multi-Unit Investor Report:

If you haven't already, be sure to subscribe to our weekly report featuring deals and data for smart multi unit investors in Utah.